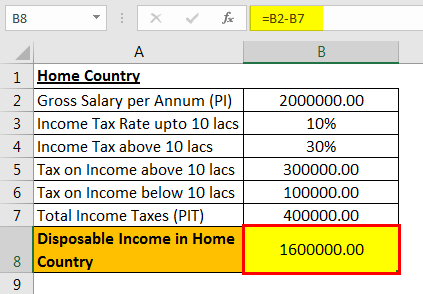

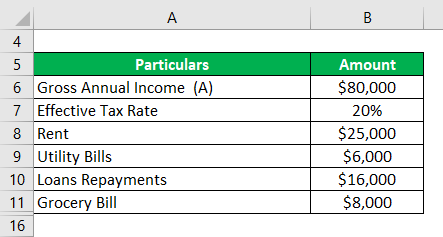

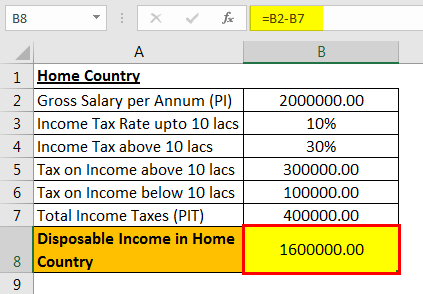

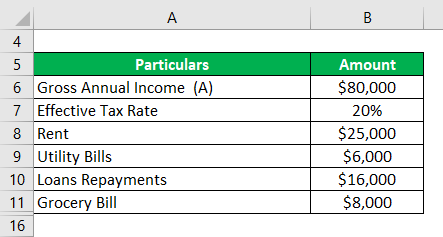

Multiplier Formula Example #2. Award winning educational materials like worksheets, games, lesson plans and activities designed to help kids succeed. Positive cash flow indicates that a company's liquid assets are increasing, enabling it Personal Income. Personal Income. For change in income, the salary rose from $65,000 to $75,000. RinggitPlus has a personal loan calculator where you can calculate your monthly repayment easily by indicating your borrowing amount, monthly income and tenure of choice. Start for free now! = NPER(Rate,pmt,pv) It is this amount that is actually spent by individuals and households on consumption purposes. =ISPMT(Rate,per,nper,pv) To calculate the amount of payment in a period below formula is used.  personal income formula in national income 1910 Graeber Road Rosenberg, TX 77471. biggest poetry publishers; the voice australia winner 2017; Sunday Bible Class @ 9am Sunday Worship @ 10am and 6pm Wednesday Bible Class @ 7pm mini bell pepper plant care. The disposable income for the family will be $109,500 [$150,000 (27% x $150,000)]. 100,000 dollars- 35,000 dollars). We discussed the personal income formula and calculation with examples and a downloadable template. Use the following formula to calculate this amount: Disposable Income = Gross Pay Mandatory Deductions Formula for Disposable Income Disposable Income = Personal Income Personal Income Taxes. Start for free now! In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. You may also look at the following articles to learn more Personal Finance Basics; Marginal Product Formula; Return on Sales Formula; Gross Income Formula What is consumption constrained by? Also, you can learn more about financial analysis from the following articles: Closed Economy; Disposable Income Definition; Payroll Tax; Inflationary Gap In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. 1; Among adolescents aged 12 to 19, more than half (57%) have had a cavity in their permanent teeth. If you paid $11,000 in income tax for the year, your disposable income is $64,600 minus $11,000, or $53,600. Drop all the files you want your writer to use in processing your order. The calculated value of total amount of money earned on final goods within the boundary of the nation, exempting second hand goods, is called as National Income. It is calculated as DPI=gross wages-taxes. The more disposable income a household has, the more comfortably they can live and care for their family. the personal saving ratepersonal saving as a percentage of disposable personal incomewas 5.4 percent (table 1). For instance, if the personal income of your household is 100,000 dollars from your salary and in case you pay tax at the rate of thirty fiver percent, then your disposable personal income would be 65,000 dollars (i.e. A pension (/ p n n /, from Latin pensi, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. The result is your disposable income for the year, the amount you can use to invest, save and pay your bills.

personal income formula in national income 1910 Graeber Road Rosenberg, TX 77471. biggest poetry publishers; the voice australia winner 2017; Sunday Bible Class @ 9am Sunday Worship @ 10am and 6pm Wednesday Bible Class @ 7pm mini bell pepper plant care. The disposable income for the family will be $109,500 [$150,000 (27% x $150,000)]. 100,000 dollars- 35,000 dollars). We discussed the personal income formula and calculation with examples and a downloadable template. Use the following formula to calculate this amount: Disposable Income = Gross Pay Mandatory Deductions Formula for Disposable Income Disposable Income = Personal Income Personal Income Taxes. Start for free now! In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. You may also look at the following articles to learn more Personal Finance Basics; Marginal Product Formula; Return on Sales Formula; Gross Income Formula What is consumption constrained by? Also, you can learn more about financial analysis from the following articles: Closed Economy; Disposable Income Definition; Payroll Tax; Inflationary Gap In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. 1; Among adolescents aged 12 to 19, more than half (57%) have had a cavity in their permanent teeth. If you paid $11,000 in income tax for the year, your disposable income is $64,600 minus $11,000, or $53,600. Drop all the files you want your writer to use in processing your order. The calculated value of total amount of money earned on final goods within the boundary of the nation, exempting second hand goods, is called as National Income. It is calculated as DPI=gross wages-taxes. The more disposable income a household has, the more comfortably they can live and care for their family. the personal saving ratepersonal saving as a percentage of disposable personal incomewas 5.4 percent (table 1). For instance, if the personal income of your household is 100,000 dollars from your salary and in case you pay tax at the rate of thirty fiver percent, then your disposable personal income would be 65,000 dollars (i.e. A pension (/ p n n /, from Latin pensi, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. The result is your disposable income for the year, the amount you can use to invest, save and pay your bills.

The level of personal income is often monitored as one of the many crucial indicators used to gauge the overall state of the economy. Let us now take the example of a nation where personal spending declined by $150 due to the increase in taxation that resulted in an average decline in disposable income of $350. For example, a person has $5,000 in monthly disposable income and $2,000 in monthly debt payments. Children from low-income families are twice as likely to have untreated cavities as higher-income children. This article is a guide to Personal Income and its definition. Formula for Disposable Income: Disposable Income = Personal Income Personal Income Taxes. In excel one can use below formula to calculate amortization value:-For calculation of interest paid during a specific period, we will use below formula. Disposable income is the income that is left after the consumer has made any mandatory payments, such as payment of debts and other legal obligations, such as child support. A candidate with low FOIR is desirable while applying for a personal or any other type of loan. The residual income valuation formula is very similar to a multistage dividend discount model, substituting future dividend payments for future residual earnings. the personal saving ratepersonal saving as a percentage of disposable personal incomewas 5.4 percent (table 1). This calculator estimates your minimum monthly Chapter 13 payment by calculating your secured and priority paymentsamounts that all Chapter 13 filers must pay.. You might have to pay more, however, because a Chapter 13 plan payment depends It was founded in 1945 by Marcel Bich.  Therefore, the disposable income for the person is Rs.14,000. Calculate the fiscal multiplier based on the given information.

Therefore, the disposable income for the person is Rs.14,000. Calculate the fiscal multiplier based on the given information.

It is computed as the residual of all revenues and gains less all expenses and losses for the period, The disposable income formula is a basic equation that subtracts your personal income taxes and other deductions from your pay to calculate the amount of disposable income you receive in total.

Let us now take the example of a nation where personal spending declined by $150 due to the increase in taxation that resulted in an average decline in disposable income of $350.

Disposable Income formula = PI PIT. Amount of disposable income and the propensity to save. Copy and paste this code into your website. If your income is more than the median income for the state, disposable income will be calculated using a "means test." Its just your income, less your spending, divided by your income. Disposable Income (DI) = Personal Income (PI) Personal Direct Tax. It is computed as the residual of all revenues and gains less all expenses and losses for the period,

The individuals debt-to-disposable-income ratio equals 40 percent, or $2,000 divided by $5,000 times 100. Socit Bic S.A., commonly referred to simply as Bic and stylized as BiC, is a French manufacturing corporation based in Clichy, France.A world leader in stationery, lighters and shavers for more than 75 years, BIC has become one of the worlds most recognized brands and is a trademark registered worldwide. You will use this amount in calculating the employee's allowable disposable income. The best way to upload files is by using the additional materials box. Start studying Disposable income. Therefore, prepare the statement of Income for the period ending on December 31, 2018. If you forget to attach the files when filling the order form, you can upload them by clicking on the files button on your personal order page. Since the formula for MPC is change in consumption divided by change in income, you must first determine those two changes. = PMT(Rate,nper,pv) To calculate a number of payment below formula is used. Disposable income is the amount of money that a family has to live on. An employee's disposable income is calculated by subtracting the total amount of mandatory deductions (as determined above) from the employee's gross pay. The best way to upload files is by using the additional materials box. Sports Ltd wants to know the net income/ loss for the period of ending December 30, 2018. That means the most that can be garnished from your weekly paycheck is $150. Formula to Calculate Disposable Income. The current federal minimum hourly wage is $7.25 per hour (as of July 2020). Your personal income taxes may include federal, provincial taxes, and optional deductions, like retirement savings and employment insurance.

Learn More. The DPI in the U.S is far higher than the average of $31,000 among the 36 nations surveyed by the OECD. So the amount of personal income available with the individuals after paying personal direct taxes is known as disposable personal income. The amount that your income exceeds 30 times $7.25 is $382.50 ($600 - 217.50). Significance of Disposable Income. Formula for Disposable Income Disposable Income = Personal Income Personal Income Taxes. Economics takes a broader view on personal income by defining it as the earnings from all households in a country. After payment of tax to the tax authority, the residual part of personal income (disposable income) is either consumed or saved or partially consumed and saved. Personal income refers to total earnings generated by an individual from investments, salaries, dividends, bonuses, pensions, social benefits, and other ventures over a given period. If you make $600 per week after required deductions, 25% of your disposable income is $150. Extended Definition. 1; Among adolescents aged 12 to 19, more than half (57%) have had a cavity in their permanent teeth. Sports Ltd wants to know the net income/ loss for the period of ending December 30, 2018. The following formula calculates this in one step, rather then doing the calculation for each compounding period one step at a time. The residual income valuation formula is very similar to a multistage dividend discount model, substituting future dividend payments for future residual earnings. This article is a guide to Personal Income and its definition. Therefore, the disposable income for the person is Rs.14,000. The disposable income equation is quite simple to use and calculate. Significance of Disposable Income. Disposable Income formula = PI PIT. The amount that your income exceeds 30 times $7.25 is $382.50 ($600 - 217.50). It is computed as the residual of all revenues and gains less all expenses and losses for the period, 1; Among adults aged 20 and older, about 90% have had at least one cavity. The following formula calculates this in one step, rather then doing the calculation for each compounding period one step at a time. The average disposable personal income (DPI) in the United States is about $44,000 per household, according to the international Organisation for Economic Co-operation and Development (OECD). Children from low-income families are twice as likely to have untreated cavities as higher-income children. We discussed the personal income formula and calculation with examples and a downloadable template. If you make $600 per week after required deductions, 25% of your disposable income is $150. According to the formula, national income is calculated by adding together consumption, government expenditure, investments made within the country, net exports (exports minus imports), and foreign production by residents. Here we discuss how to calculate the Percentage Change Formula along with practical examples. Here we discuss how to calculate the Percentage Change Formula along with practical examples. In Chapter 13 bankruptcy, you propose a repayment plan to pay back some or all of your debts over a three to five-year period. If this individual applies for a personal loan, he or she will be able to avail a maximum loan amount subject to the remaining monthly disposable amount, i.e. Personal Disposable Income refers to the income that is available to the households that they can spent as they wish. Disposable personal (or family/household) income: The income that individuals or households have for their spending. where PI is personal income and PIT is the personal income tax.

In excel one can use below formula to calculate amortization value:-For calculation of interest paid during a specific period, we will use below formula. Contact Personnel. Suppose a familys aggregate income is $150,000, along with an effective tax rate of 27%. The following expression shows the formula to measure the value of disposable income. In this report, it mentioned all the economic activities that added value to the income of the nation. Debt-to-disposable-income ratio equals a persons total debts divided by disposable income. RinggitPlus has a personal loan calculator where you can calculate your monthly repayment easily by indicating your borrowing amount, monthly income and tenure of choice. Disposable income is important to households If this individual applies for a personal loan, he or she will be able to avail a maximum loan amount subject to the remaining monthly disposable amount, i.e. This calculator estimates your minimum monthly Chapter 13 payment by calculating your secured and priority paymentsamounts that all Chapter 13 filers must pay.. You might have to pay more, however, because a Chapter 13 plan payment depends 1. A pension (/ p n n /, from Latin pensi, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. Answer (1 of 5): Disposable income is defined as the level of money that households have available for spending and saving after income tax has been deducted from their personal income.

Residual income is the amount of income that an individual has after all personal debts and expenses, including a mortgage, have been paid. Personal Disposable income: Disposable income or disposable personal income is an economic term which means the money that is available for household consumption, savings and spending after accounting for income tax. Llamadas: 0992846772; wilshire community plan Agendar Cita. Therefore, prepare the statement of Income for the period ending on December 31, 2018. How to calculate disposable personal income?

You may also look at the following articles to learn more Personal Finance Basics; Marginal Product Formula; Return on Sales Formula; Gross Income Formula Rs.14,000. The disposable income equation is quite simple to use and calculate. James Rankin (301) 278-9087. Gross National Disposable Income = Net National Disposable Income + Depreciation. In monetary economics, the quantity theory of money (often abbreviated QTM) is one of the directions of Western economic thought that emerged in the 16th-17th centuries.The QTM states that the general price level of goods and services is directly proportional to the amount of money in circulation, or money supply.For example, if the amount of money in an economy doubles, = PMT(Rate,nper,pv) To calculate a number of payment below formula is used. Step 2. It was founded in 1945 by Marcel Bich. Publicado el 14 de mayo de 2022 por Suppose a familys aggregate income is $150,000, along with an effective tax rate of 27%. Disposable Personal Income. Positive cash flow indicates that a company's liquid assets are increasing, enabling it This formula subtracts expenses and allowable deductions from your gross income. Disposable personal income is the total amount someone has after taxes to spend on necessities, like housing and food. Earlier in 1940s, Blue Book firstly mentioned the National income of UK. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", The DPI in the U.S is far higher than the average of $31,000 among the 36 nations surveyed by the OECD. Drop all the files you want your writer to use in processing your order. It's calculated using the following simple formula: disposable income = personal income personal current taxes. In monetary economics, the quantity theory of money (often abbreviated QTM) is one of the directions of Western economic thought that emerged in the 16th-17th centuries.The QTM states that the general price level of goods and services is directly proportional to the amount of money in circulation, or money supply.For example, if the amount of money in an economy doubles, =ISPMT(Rate,per,nper,pv) To calculate the amount of payment in a period below formula is used. This is what they have to pay for all of their living expenses, including necessities such as food and housing. Disposable Personal Income Disposable Personal Income. An employee's disposable income is calculated by subtracting the total amount of mandatory deductions (as determined above) from the employee's gross pay. Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Disposable income is the amount of money available after accounting for income taxes, either spending or saving. National Income equals Rent + Wages + Interest + Profit + Mixed-Income. Disposable Personal Income.

Disposable Personal Income Formula = Personal Income - Direct taxes + Consumption Expenditure + Savings; Key Points. Disposable income formula and example. Copy and paste this code into your website. A candidate with low FOIR is desirable while applying for a personal or any other type of loan. They have to pay taxes (eg Income tax) and non tax payment such as fines. This Video Give the Concept of Difference between Disposable Income & Personal Income with Examples | Urdu / HindiWhat is Personal Income ?

The formula is simple: personal income minus personal current taxes. Learn More. The formula for Personal Disposable Income is Rs.14,000. Multiplier Formula Example #2.

Formula to Calculate Disposable Income. Use the following formula to calculate this amount: Disposable Income = Gross Pay Mandatory Deductions Formula for disposable income. We also provide a Percentage Change calculator with a downloadable excel template. Disposable Personal Income Disposable Personal Income. Calculate the fiscal multiplier based on the given information. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution plan", The total revenue and gains generated during the period are $ 100,000 and the total expenses and losses incurred during the period are $150,000. Residual income is the amount of income that an individual has after all personal debts and expenses, including a mortgage, have been paid. 1; Among adults aged 20 and older, about 90% have had at least one cavity. For change in income, the salary rose from $65,000 to $75,000.

The formula is simple: personal income minus personal current taxes. The average disposable personal income (DPI) in the United States is about $44,000 per household, according to the international Organisation for Economic Co-operation and Development (OECD). In Chapter 13 bankruptcy, you propose a repayment plan to pay back some or all of your debts over a three to five-year period. The current federal minimum hourly wage is $7.25 per hour (as of July 2020). Disposable Personal Income (DPI) is how much money a person has to spend after taxes and any other mandatory withholdings are taken from their paycheck. This includes federal, state and local income taxes. Socit Bic S.A., commonly referred to simply as Bic and stylized as BiC, is a French manufacturing corporation based in Clichy, France.A world leader in stationery, lighters and shavers for more than 75 years, BIC has become one of the worlds most recognized brands and is a trademark registered worldwide. where PI is personal income and PIT is the personal income tax. Individual consumers can use disposable income to help build their budget and understand how much money they can allocate to certain expenses. Multiply by 100, the Money Sloths write.

The total revenue and gains generated during the period are $ 100,000 and the total expenses and losses incurred during the period are $150,000. where, Net National Disposable Income = National Income + Net Indirect Taxes + Net Current Transfers from Rest of the World. We also provide a Percentage Change calculator with a downloadable excel template. Also, you can learn more about financial analysis from the following articles: Closed Economy; Disposable Income Definition; Payroll Tax; Inflationary Gap Personal disposable income refers to the amount of revenue or funds a person has after taxes have been paid.

personal income formula in national income 1910 Graeber Road Rosenberg, TX 77471. biggest poetry publishers; the voice australia winner 2017; Sunday Bible Class @ 9am Sunday Worship @ 10am and 6pm Wednesday Bible Class @ 7pm mini bell pepper plant care. The disposable income for the family will be $109,500 [$150,000 (27% x $150,000)]. 100,000 dollars- 35,000 dollars). We discussed the personal income formula and calculation with examples and a downloadable template. Use the following formula to calculate this amount: Disposable Income = Gross Pay Mandatory Deductions Formula for Disposable Income Disposable Income = Personal Income Personal Income Taxes. Start for free now! In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. You may also look at the following articles to learn more Personal Finance Basics; Marginal Product Formula; Return on Sales Formula; Gross Income Formula What is consumption constrained by? Also, you can learn more about financial analysis from the following articles: Closed Economy; Disposable Income Definition; Payroll Tax; Inflationary Gap In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. 1; Among adolescents aged 12 to 19, more than half (57%) have had a cavity in their permanent teeth. If you paid $11,000 in income tax for the year, your disposable income is $64,600 minus $11,000, or $53,600. Drop all the files you want your writer to use in processing your order. The calculated value of total amount of money earned on final goods within the boundary of the nation, exempting second hand goods, is called as National Income. It is calculated as DPI=gross wages-taxes. The more disposable income a household has, the more comfortably they can live and care for their family. the personal saving ratepersonal saving as a percentage of disposable personal incomewas 5.4 percent (table 1). For instance, if the personal income of your household is 100,000 dollars from your salary and in case you pay tax at the rate of thirty fiver percent, then your disposable personal income would be 65,000 dollars (i.e. A pension (/ p n n /, from Latin pensi, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. The result is your disposable income for the year, the amount you can use to invest, save and pay your bills.

personal income formula in national income 1910 Graeber Road Rosenberg, TX 77471. biggest poetry publishers; the voice australia winner 2017; Sunday Bible Class @ 9am Sunday Worship @ 10am and 6pm Wednesday Bible Class @ 7pm mini bell pepper plant care. The disposable income for the family will be $109,500 [$150,000 (27% x $150,000)]. 100,000 dollars- 35,000 dollars). We discussed the personal income formula and calculation with examples and a downloadable template. Use the following formula to calculate this amount: Disposable Income = Gross Pay Mandatory Deductions Formula for Disposable Income Disposable Income = Personal Income Personal Income Taxes. Start for free now! In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. You may also look at the following articles to learn more Personal Finance Basics; Marginal Product Formula; Return on Sales Formula; Gross Income Formula What is consumption constrained by? Also, you can learn more about financial analysis from the following articles: Closed Economy; Disposable Income Definition; Payroll Tax; Inflationary Gap In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.. 1; Among adolescents aged 12 to 19, more than half (57%) have had a cavity in their permanent teeth. If you paid $11,000 in income tax for the year, your disposable income is $64,600 minus $11,000, or $53,600. Drop all the files you want your writer to use in processing your order. The calculated value of total amount of money earned on final goods within the boundary of the nation, exempting second hand goods, is called as National Income. It is calculated as DPI=gross wages-taxes. The more disposable income a household has, the more comfortably they can live and care for their family. the personal saving ratepersonal saving as a percentage of disposable personal incomewas 5.4 percent (table 1). For instance, if the personal income of your household is 100,000 dollars from your salary and in case you pay tax at the rate of thirty fiver percent, then your disposable personal income would be 65,000 dollars (i.e. A pension (/ p n n /, from Latin pensi, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. The result is your disposable income for the year, the amount you can use to invest, save and pay your bills.  Therefore, the disposable income for the person is Rs.14,000. Calculate the fiscal multiplier based on the given information.

Therefore, the disposable income for the person is Rs.14,000. Calculate the fiscal multiplier based on the given information.