Taxation of profit on sale of the jointly owned property If the co-owned property is sold, each co-owner has to offer the capital gain as applicable on his share of the building. You will learn about the types of taxes you have to pay: Federal Capital Gains Tax (CGT) (long-term and short-term), state taxes, and depreciation recapture.

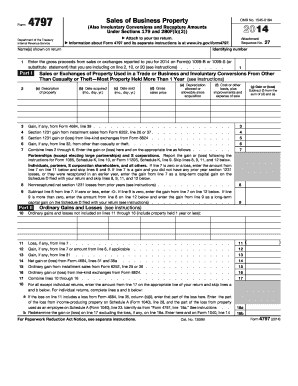

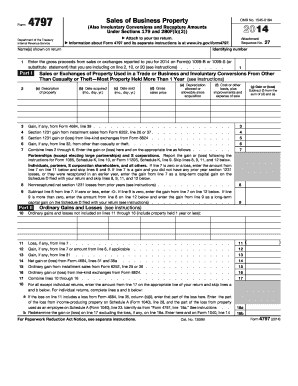

It applies to meal expenses you have for the production of income, including rental or royalty income. ; Title Costs such as the legal fees incurred when organising and Short-term capital gains tax rates are based on the normal income tax rate. Lets try an example. The cost basis for a rental property is actually the cost of acquiring the property considering not just the price, but also expenses incurred in the sale. If youre thinking about selling your rental property, you need to know how to calculate capital gains using depreciation recapture. Karl and Louisa bought a residential rental property in November 2016 for a purchase price of $750,000. If you sell a rental property for more than it cost, you may have a capital gain.. This guide explains all tax implications of selling a commercial property. Special tax provisions, however, apply with respect to the calculation of gain on property acquired before June 1, 1971. This like-kind exchange is called a 1031 exchange after the relevant section of the tax code. Capital assets are investments like house, land, stocks, mutual funds, jewelry, trademarks etc.The gain/profit is considered an income, and therefore, you are required to pay tax for that particular amount in the same year you have transferred the capital asset. However according to [Reg. The law $515,000 Last Sold Price. This handy calculator helps you avoid tedious number-crunching, but it should only be used for a back-of-the-envelope approximation. Karl and Louisa bought a residential rental property in November 2016 for a purchase price of $750,000. Calculate the capital gain or loss

On top of that, California will charge another 1% to 13.3% when you sell. (Thats 3.9% annual appreciation in If you rent out your property for six years or less, you can use this to gain a full capital gains tax exemption, as long as youre not treating another property as your main residence. Use our calculator or steps to calculate your CGT. ROI can be expressed as a percentage of the original value. When youre a California landlord selling a rental property. Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. 1. This means that your rental propertys rate of return is 6.9%. The amount of depreciation you claim is the propertys value divided by 27.5 years. Keep reading to learn how to calculate capital gains and estimate the amount of taxes owed after a home sale. Capital gains tax: $73,725 total gain $24,725 depreciation recapture = $49,000 x 15% seller capital gain tax rate = $7,350.

The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year. This 25% cap was instituted in 2013. Rental property capital gains tax = taxable capital gain x marginal tax rate. Previously, the cap was 15%. Here's an example: You buy a rental property on May 15. If this occurs when you buy or sell your rental property, you must include the loan amount in your capital gain calculation. The total capital gains is: $250,000 $100,000 = $150,000 (total capital gains) Since your property is in Canada, 50% of the total capital gains profit is subject to tax. Figure out the taxable gain on the sale of the property. The capital proceeds from the sale of the shares are $5,500.The reduced cost base is $10,000. Rhis capital loss on the shares is: $5,500 $10,000 = ($4,500)Rhi also had a capital gain of $70,000 on her investment property (see previous example).$70,000 (gains) $4,500 (losses) = $65,500Rhi has a capital gain so she continues to step 7.More items If you have a capital gain, the amount minus the expenses incurred for the sale of the building will be entered by the program on federal Schedule 3 and on Quebec Schedule G. 10. To calculate capital gains, youll first have to determine your assets basis, or the price you paid plus any taxes and additional funds youve reinvested in the property. sale costs of $1,300 conveyancing fees + $12,500 agent's commission. Step 3. If you sell rental or investment property, you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. Investors love to boast about their great stock picks, but beware of those who use fancy math to calculate their gains. Of course, youll also have to get the property ready for sale. $469,051. Use this tool to estimate capital gains taxes you may owe after selling an investment property. Those costs are "capitalized." The goal of rental property investing is to generate a positive cash flow, so the amount of money earned on the property is greater than the expenses going into managing the property. If the property you transfer for services is subject to restrictions that affect its value, you generally can't deduct it and don't report gain or loss until it is substantially vested in the recipient. Now, deduct Elaines cost basis from her net proceeds to determine the total capital gains on the investment property. 2,148 Sq. Briefly, the idea behind depreciation is that a rental property loses value over time. The real rate of return on Canadian residential real estate has been about 3.9% annually over the past 30 years. Starting in Drake18, use the section Business or Rental Use of Home to enter the percentage of the property used for the business or rental. Short term capital gains tax: This is tax paid on profits made from sale of rental property held for 12 months or less. 6:55 Sitting down in the parlor with Search real estate for sale, discover new homes, shop mortgages, find property records & take virtual tours of houses, condos & apartments on realtor. How to report the sale of a rental property. However, if the recipient pays for the property, you must report any gain at the time of the transfer up to the amount paid. Read! To calculate the capital gain and capital gains tax liability, subtract your adjusted basis from the sales price of the property, then multiply by the applicable long-term capital gains tax rate: Capital gain = $134,400 sales price $74,910 adjusted basis = $59,490 gains subject to tax. In addition, as with the ownership of any equity, rental properties give the investor the possibility of earning profit from the appreciation, or increase in value over time, of the property. He received possession of the property from the builder on 2nd of September, 2017. (Thats 3.9% annual appreciation in excess of inflation.) To calculate the capital gain and capital gains tax liability, subtract your adjusted basis from the sales price of the property, then multiply by the applicable long-term capital gains tax rate: Capital gain = $134,400 sales price $74,910 adjusted basis = $59,490 gains subject to tax. This 25% cap was instituted in 2013. Total taxes owed for selling the rental property: Were going to use a sale of $400,000 on a rental property that was purchased for $340,000 four years ago. A property was my principal residence for the first 2 of the 5 years which ended on the date of the sale of the property. For example, if contracts are exchanged on 4 June 2022 and settlement happens on 6 July 2022, Rhi must report her capital gain in her income tax return for the financial year ending 30 June 2022. The real rate of return on Canadian residential real estate has been about 3.9% annually over the past 30 years. In addition to that, you will learn about the ways to Property must generate at least a 15% ROI, cash on cash. That means the rent minus the debt (if mortgaged) and expenses must equal 15% or more. For example, a $20K down payment would have to yield at LEAST a yearly cash flow of $3,000. net capital loss, you can carry it forward and deduct it from your capital gains in later years. Go to Rental Property Accounting Spreadsheet website using the links below. Evaluating Sale Price Once you have sold your rental property, you must subtract the adjusted basis from the selling price to determine what Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. A capital gains distribution is a payment by a mutual fund or an exchange-traded fund (ETF) of a portion of the proceeds from the fund's sales of stocks and other assets from within its portfolio. ; Ownership Costs such as those incurred when searching and inspecting for properties. Nearby homes similar to 630 E Houston Ave have recently sold between $365K to $562K at an average of $180 per square foot. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. However, if selling a second home, a rental property, or selling other types of real estate investments, the seller may have to declare and pay taxes on at least part of their capital gain. Note than a higher adjusted basis gives a lower gain on sale, which may be beneficial for the taxpayer. Depreciation is a tax deduction you can claim on your propertys costs of owning and improving it. Let me give you a short tutorial. You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. For a married couple filing jointly with a taxable income of $280,000 and capital gains of $100,000, taxes on the profits from the sale of a rental property would amount to $15,000. HDB flat owners can use this calculator to work out estimated sales proceeds. Calculate the purchase price or basis of your rental property. = Selling Price of Rental Property Adjusted Cost Basis = (Capital Gains x Tax Rate) + To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost. Correctly reporting the sale of a rental property is the responsibility of every real estate investor. To calculate your gain, subtract the adjusted basis of your property at the time of sale from the sales price your rental property sold for, including sales expenses such as legal fees and sales commissions paid. Capital gains tax generally applies when you sell an investment or asset for more than what you paid for it. To calculate capital gains on sale of rental property, we have to calculate the adjusted cost base from purchase and the net proceeds from sale. Seniors, like other property owners, pay capital gains tax on the sale of real estate. Rental property owners do not usually qualify for any portion of the capital gains exemption. They may also need to pay the net investment income tax. When this tax is applicable to sellers, they will need to pay 3.8 percent of the net income from their investments along with their capital gains taxes. Cost of investment $150,000 x 50% = $75,000. Mr Kiran acquired an under-construction property for Rs. When an entry is made in that field, Wks Home is produced in view mode that shows the allocation of the gain and/or loss for personal and business use. Calculate the purchase price or basis of your rental property.. Depreciation recapture tax rates. We will guide you on how to place your essay help, proofreading and editing your draft fixing the grammar, spelling, or formatting of your paper easily and cheaply. In most cases, youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. Rental property tax information doesn't have to be dull and boring. Step 1. SOLD MAY 6, 2022. End of example Figure out your overall gain on the sale of the property. 4 Beds. So, if you bought a property for $1 million and sold it for $1.5 million, your ROI would be: ($1.5 million $1 million) / $1 million = 0.5 or 50%. Capital Gains Tax Example. In order to qualify, the homeowner (s) must own and also use the home as a primary residence for at least 2 of the past 5 years. This can result in a small amount of tax basis in the property that you are trying to sell. The gain is the difference between the "adjusted basis" and the sale price. Suppose, for example, you want to buy a property for $250,000, but sell it for $350,000 after assuming it can be bought and held.An increase in capital of $350,000 x $250,000 would correspond to a $100,000 profit.The only half of a capital gain in Canada is that which is taxable, hence the $50,000 result Step 6: Subtract the cost of capital gain from the selling price of the property to know the net gain of the transaction. To give you a quick and dirty estimation of how much tax you would have to pay, you can simply use 50% as your tax rate. To avoid recognizing the gain on the sale of your first property, you can transfer your cost basis to the new property. There is a great tip about accounting for all It only refers to the time your property has an active tenant. Enter your Username and Password and click on Log In. To work out the gain, you simply deduct the "cost basis" of the house from the "net proceeds" you receive from the sale. List the dispositions of all your rental properties on Schedule 3, Capital Gains (or Losses).For more information on how to calculate your taxable capital gain, see Guide T4037, Capital Gains.. and up. If you sold the property for $600,000, your gain will be $163,000 ($600,000 amount realized minus $437,000 adjusted basis). First, determine your selling costs. How Are Capital Gains Calculated On Sale Of Rental Property? They incur costs of purchase, including stamp duty and legal fees of $30,000. 1. This means that half of the profit you earn from selling an asset is taxed, and the other half is yours to keep tax-free. Now, to calculate the rental propertys ROI, follow the previous cap rate formula and divide the annual return ($7,600) by the total investment you initially made ($110,000). and up. 9. You can determine your total gain by deducting the So the closing costs you paid to purchase the property and that you could not deduct previously are effectively deducted when you sell. It applies to the portion of the gain attributable to the depreciation deductions youve already taken. To conclude, a gain or loss on the sale of your rental property, you subtract your adjusted cost basis from the actual selling price of your rental property. Additionally, taxable gain on the sale may be subject to a 3.8% Net If this is a negative number, you've made a loss. To figure out the basis of property received as a gift, you must know three amounts: The donor's adjusted basis just before the donor made the gift. All the documents need to be submerged so they are completely saturated and can be broken down.

On top of that, California will charge another 1% to 13.3% when you sell. (Thats 3.9% annual appreciation in If you rent out your property for six years or less, you can use this to gain a full capital gains tax exemption, as long as youre not treating another property as your main residence. Use our calculator or steps to calculate your CGT. ROI can be expressed as a percentage of the original value. When youre a California landlord selling a rental property. Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. 1. This means that your rental propertys rate of return is 6.9%. The amount of depreciation you claim is the propertys value divided by 27.5 years. Keep reading to learn how to calculate capital gains and estimate the amount of taxes owed after a home sale. Capital gains tax: $73,725 total gain $24,725 depreciation recapture = $49,000 x 15% seller capital gain tax rate = $7,350.

On top of that, California will charge another 1% to 13.3% when you sell. (Thats 3.9% annual appreciation in If you rent out your property for six years or less, you can use this to gain a full capital gains tax exemption, as long as youre not treating another property as your main residence. Use our calculator or steps to calculate your CGT. ROI can be expressed as a percentage of the original value. When youre a California landlord selling a rental property. Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. 1. This means that your rental propertys rate of return is 6.9%. The amount of depreciation you claim is the propertys value divided by 27.5 years. Keep reading to learn how to calculate capital gains and estimate the amount of taxes owed after a home sale. Capital gains tax: $73,725 total gain $24,725 depreciation recapture = $49,000 x 15% seller capital gain tax rate = $7,350.

The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year. This 25% cap was instituted in 2013. Rental property capital gains tax = taxable capital gain x marginal tax rate. Previously, the cap was 15%. Here's an example: You buy a rental property on May 15. If this occurs when you buy or sell your rental property, you must include the loan amount in your capital gain calculation. The total capital gains is: $250,000 $100,000 = $150,000 (total capital gains) Since your property is in Canada, 50% of the total capital gains profit is subject to tax. Figure out the taxable gain on the sale of the property. The capital proceeds from the sale of the shares are $5,500.The reduced cost base is $10,000. Rhis capital loss on the shares is: $5,500 $10,000 = ($4,500)Rhi also had a capital gain of $70,000 on her investment property (see previous example).$70,000 (gains) $4,500 (losses) = $65,500Rhi has a capital gain so she continues to step 7.More items If you have a capital gain, the amount minus the expenses incurred for the sale of the building will be entered by the program on federal Schedule 3 and on Quebec Schedule G. 10. To calculate capital gains, youll first have to determine your assets basis, or the price you paid plus any taxes and additional funds youve reinvested in the property. sale costs of $1,300 conveyancing fees + $12,500 agent's commission. Step 3. If you sell rental or investment property, you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. Investors love to boast about their great stock picks, but beware of those who use fancy math to calculate their gains. Of course, youll also have to get the property ready for sale. $469,051. Use this tool to estimate capital gains taxes you may owe after selling an investment property. Those costs are "capitalized." The goal of rental property investing is to generate a positive cash flow, so the amount of money earned on the property is greater than the expenses going into managing the property. If the property you transfer for services is subject to restrictions that affect its value, you generally can't deduct it and don't report gain or loss until it is substantially vested in the recipient. Now, deduct Elaines cost basis from her net proceeds to determine the total capital gains on the investment property. 2,148 Sq. Briefly, the idea behind depreciation is that a rental property loses value over time. The real rate of return on Canadian residential real estate has been about 3.9% annually over the past 30 years. Starting in Drake18, use the section Business or Rental Use of Home to enter the percentage of the property used for the business or rental. Short term capital gains tax: This is tax paid on profits made from sale of rental property held for 12 months or less. 6:55 Sitting down in the parlor with Search real estate for sale, discover new homes, shop mortgages, find property records & take virtual tours of houses, condos & apartments on realtor. How to report the sale of a rental property. However, if the recipient pays for the property, you must report any gain at the time of the transfer up to the amount paid. Read! To calculate the capital gain and capital gains tax liability, subtract your adjusted basis from the sales price of the property, then multiply by the applicable long-term capital gains tax rate: Capital gain = $134,400 sales price $74,910 adjusted basis = $59,490 gains subject to tax. In addition, as with the ownership of any equity, rental properties give the investor the possibility of earning profit from the appreciation, or increase in value over time, of the property. He received possession of the property from the builder on 2nd of September, 2017. (Thats 3.9% annual appreciation in excess of inflation.) To calculate the capital gain and capital gains tax liability, subtract your adjusted basis from the sales price of the property, then multiply by the applicable long-term capital gains tax rate: Capital gain = $134,400 sales price $74,910 adjusted basis = $59,490 gains subject to tax. This 25% cap was instituted in 2013. Total taxes owed for selling the rental property: Were going to use a sale of $400,000 on a rental property that was purchased for $340,000 four years ago. A property was my principal residence for the first 2 of the 5 years which ended on the date of the sale of the property. For example, if contracts are exchanged on 4 June 2022 and settlement happens on 6 July 2022, Rhi must report her capital gain in her income tax return for the financial year ending 30 June 2022. The real rate of return on Canadian residential real estate has been about 3.9% annually over the past 30 years. In addition to that, you will learn about the ways to Property must generate at least a 15% ROI, cash on cash. That means the rent minus the debt (if mortgaged) and expenses must equal 15% or more. For example, a $20K down payment would have to yield at LEAST a yearly cash flow of $3,000. net capital loss, you can carry it forward and deduct it from your capital gains in later years. Go to Rental Property Accounting Spreadsheet website using the links below. Evaluating Sale Price Once you have sold your rental property, you must subtract the adjusted basis from the selling price to determine what Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. A capital gains distribution is a payment by a mutual fund or an exchange-traded fund (ETF) of a portion of the proceeds from the fund's sales of stocks and other assets from within its portfolio. ; Ownership Costs such as those incurred when searching and inspecting for properties. Nearby homes similar to 630 E Houston Ave have recently sold between $365K to $562K at an average of $180 per square foot. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. However, if selling a second home, a rental property, or selling other types of real estate investments, the seller may have to declare and pay taxes on at least part of their capital gain. Note than a higher adjusted basis gives a lower gain on sale, which may be beneficial for the taxpayer. Depreciation is a tax deduction you can claim on your propertys costs of owning and improving it. Let me give you a short tutorial. You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. For a married couple filing jointly with a taxable income of $280,000 and capital gains of $100,000, taxes on the profits from the sale of a rental property would amount to $15,000. HDB flat owners can use this calculator to work out estimated sales proceeds. Calculate the purchase price or basis of your rental property. = Selling Price of Rental Property Adjusted Cost Basis = (Capital Gains x Tax Rate) + To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost. Correctly reporting the sale of a rental property is the responsibility of every real estate investor. To calculate your gain, subtract the adjusted basis of your property at the time of sale from the sales price your rental property sold for, including sales expenses such as legal fees and sales commissions paid. Capital gains tax generally applies when you sell an investment or asset for more than what you paid for it. To calculate capital gains on sale of rental property, we have to calculate the adjusted cost base from purchase and the net proceeds from sale. Seniors, like other property owners, pay capital gains tax on the sale of real estate. Rental property owners do not usually qualify for any portion of the capital gains exemption. They may also need to pay the net investment income tax. When this tax is applicable to sellers, they will need to pay 3.8 percent of the net income from their investments along with their capital gains taxes. Cost of investment $150,000 x 50% = $75,000. Mr Kiran acquired an under-construction property for Rs. When an entry is made in that field, Wks Home is produced in view mode that shows the allocation of the gain and/or loss for personal and business use. Calculate the purchase price or basis of your rental property.. Depreciation recapture tax rates. We will guide you on how to place your essay help, proofreading and editing your draft fixing the grammar, spelling, or formatting of your paper easily and cheaply. In most cases, youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. Rental property tax information doesn't have to be dull and boring. Step 1. SOLD MAY 6, 2022. End of example Figure out your overall gain on the sale of the property. 4 Beds. So, if you bought a property for $1 million and sold it for $1.5 million, your ROI would be: ($1.5 million $1 million) / $1 million = 0.5 or 50%. Capital Gains Tax Example. In order to qualify, the homeowner (s) must own and also use the home as a primary residence for at least 2 of the past 5 years. This can result in a small amount of tax basis in the property that you are trying to sell. The gain is the difference between the "adjusted basis" and the sale price. Suppose, for example, you want to buy a property for $250,000, but sell it for $350,000 after assuming it can be bought and held.An increase in capital of $350,000 x $250,000 would correspond to a $100,000 profit.The only half of a capital gain in Canada is that which is taxable, hence the $50,000 result Step 6: Subtract the cost of capital gain from the selling price of the property to know the net gain of the transaction. To give you a quick and dirty estimation of how much tax you would have to pay, you can simply use 50% as your tax rate. To avoid recognizing the gain on the sale of your first property, you can transfer your cost basis to the new property. There is a great tip about accounting for all It only refers to the time your property has an active tenant. Enter your Username and Password and click on Log In. To work out the gain, you simply deduct the "cost basis" of the house from the "net proceeds" you receive from the sale. List the dispositions of all your rental properties on Schedule 3, Capital Gains (or Losses).For more information on how to calculate your taxable capital gain, see Guide T4037, Capital Gains.. and up. If you sold the property for $600,000, your gain will be $163,000 ($600,000 amount realized minus $437,000 adjusted basis). First, determine your selling costs. How Are Capital Gains Calculated On Sale Of Rental Property? They incur costs of purchase, including stamp duty and legal fees of $30,000. 1. This means that half of the profit you earn from selling an asset is taxed, and the other half is yours to keep tax-free. Now, to calculate the rental propertys ROI, follow the previous cap rate formula and divide the annual return ($7,600) by the total investment you initially made ($110,000). and up. 9. You can determine your total gain by deducting the So the closing costs you paid to purchase the property and that you could not deduct previously are effectively deducted when you sell. It applies to the portion of the gain attributable to the depreciation deductions youve already taken. To conclude, a gain or loss on the sale of your rental property, you subtract your adjusted cost basis from the actual selling price of your rental property. Additionally, taxable gain on the sale may be subject to a 3.8% Net If this is a negative number, you've made a loss. To figure out the basis of property received as a gift, you must know three amounts: The donor's adjusted basis just before the donor made the gift. All the documents need to be submerged so they are completely saturated and can be broken down.

The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year. This 25% cap was instituted in 2013. Rental property capital gains tax = taxable capital gain x marginal tax rate. Previously, the cap was 15%. Here's an example: You buy a rental property on May 15. If this occurs when you buy or sell your rental property, you must include the loan amount in your capital gain calculation. The total capital gains is: $250,000 $100,000 = $150,000 (total capital gains) Since your property is in Canada, 50% of the total capital gains profit is subject to tax. Figure out the taxable gain on the sale of the property. The capital proceeds from the sale of the shares are $5,500.The reduced cost base is $10,000. Rhis capital loss on the shares is: $5,500 $10,000 = ($4,500)Rhi also had a capital gain of $70,000 on her investment property (see previous example).$70,000 (gains) $4,500 (losses) = $65,500Rhi has a capital gain so she continues to step 7.More items If you have a capital gain, the amount minus the expenses incurred for the sale of the building will be entered by the program on federal Schedule 3 and on Quebec Schedule G. 10. To calculate capital gains, youll first have to determine your assets basis, or the price you paid plus any taxes and additional funds youve reinvested in the property. sale costs of $1,300 conveyancing fees + $12,500 agent's commission. Step 3. If you sell rental or investment property, you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. Investors love to boast about their great stock picks, but beware of those who use fancy math to calculate their gains. Of course, youll also have to get the property ready for sale. $469,051. Use this tool to estimate capital gains taxes you may owe after selling an investment property. Those costs are "capitalized." The goal of rental property investing is to generate a positive cash flow, so the amount of money earned on the property is greater than the expenses going into managing the property. If the property you transfer for services is subject to restrictions that affect its value, you generally can't deduct it and don't report gain or loss until it is substantially vested in the recipient. Now, deduct Elaines cost basis from her net proceeds to determine the total capital gains on the investment property. 2,148 Sq. Briefly, the idea behind depreciation is that a rental property loses value over time. The real rate of return on Canadian residential real estate has been about 3.9% annually over the past 30 years. Starting in Drake18, use the section Business or Rental Use of Home to enter the percentage of the property used for the business or rental. Short term capital gains tax: This is tax paid on profits made from sale of rental property held for 12 months or less. 6:55 Sitting down in the parlor with Search real estate for sale, discover new homes, shop mortgages, find property records & take virtual tours of houses, condos & apartments on realtor. How to report the sale of a rental property. However, if the recipient pays for the property, you must report any gain at the time of the transfer up to the amount paid. Read! To calculate the capital gain and capital gains tax liability, subtract your adjusted basis from the sales price of the property, then multiply by the applicable long-term capital gains tax rate: Capital gain = $134,400 sales price $74,910 adjusted basis = $59,490 gains subject to tax. In addition, as with the ownership of any equity, rental properties give the investor the possibility of earning profit from the appreciation, or increase in value over time, of the property. He received possession of the property from the builder on 2nd of September, 2017. (Thats 3.9% annual appreciation in excess of inflation.) To calculate the capital gain and capital gains tax liability, subtract your adjusted basis from the sales price of the property, then multiply by the applicable long-term capital gains tax rate: Capital gain = $134,400 sales price $74,910 adjusted basis = $59,490 gains subject to tax. This 25% cap was instituted in 2013. Total taxes owed for selling the rental property: Were going to use a sale of $400,000 on a rental property that was purchased for $340,000 four years ago. A property was my principal residence for the first 2 of the 5 years which ended on the date of the sale of the property. For example, if contracts are exchanged on 4 June 2022 and settlement happens on 6 July 2022, Rhi must report her capital gain in her income tax return for the financial year ending 30 June 2022. The real rate of return on Canadian residential real estate has been about 3.9% annually over the past 30 years. In addition to that, you will learn about the ways to Property must generate at least a 15% ROI, cash on cash. That means the rent minus the debt (if mortgaged) and expenses must equal 15% or more. For example, a $20K down payment would have to yield at LEAST a yearly cash flow of $3,000. net capital loss, you can carry it forward and deduct it from your capital gains in later years. Go to Rental Property Accounting Spreadsheet website using the links below. Evaluating Sale Price Once you have sold your rental property, you must subtract the adjusted basis from the selling price to determine what Since depreciation recapture is taxed as ordinary income as opposed to capital gains, your depreciation recapture tax rate is going to be your income tax rate, with a cap at 25%. A capital gains distribution is a payment by a mutual fund or an exchange-traded fund (ETF) of a portion of the proceeds from the fund's sales of stocks and other assets from within its portfolio. ; Ownership Costs such as those incurred when searching and inspecting for properties. Nearby homes similar to 630 E Houston Ave have recently sold between $365K to $562K at an average of $180 per square foot. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. However, if selling a second home, a rental property, or selling other types of real estate investments, the seller may have to declare and pay taxes on at least part of their capital gain. Note than a higher adjusted basis gives a lower gain on sale, which may be beneficial for the taxpayer. Depreciation is a tax deduction you can claim on your propertys costs of owning and improving it. Let me give you a short tutorial. You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. For a married couple filing jointly with a taxable income of $280,000 and capital gains of $100,000, taxes on the profits from the sale of a rental property would amount to $15,000. HDB flat owners can use this calculator to work out estimated sales proceeds. Calculate the purchase price or basis of your rental property. = Selling Price of Rental Property Adjusted Cost Basis = (Capital Gains x Tax Rate) + To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost. Correctly reporting the sale of a rental property is the responsibility of every real estate investor. To calculate your gain, subtract the adjusted basis of your property at the time of sale from the sales price your rental property sold for, including sales expenses such as legal fees and sales commissions paid. Capital gains tax generally applies when you sell an investment or asset for more than what you paid for it. To calculate capital gains on sale of rental property, we have to calculate the adjusted cost base from purchase and the net proceeds from sale. Seniors, like other property owners, pay capital gains tax on the sale of real estate. Rental property owners do not usually qualify for any portion of the capital gains exemption. They may also need to pay the net investment income tax. When this tax is applicable to sellers, they will need to pay 3.8 percent of the net income from their investments along with their capital gains taxes. Cost of investment $150,000 x 50% = $75,000. Mr Kiran acquired an under-construction property for Rs. When an entry is made in that field, Wks Home is produced in view mode that shows the allocation of the gain and/or loss for personal and business use. Calculate the purchase price or basis of your rental property.. Depreciation recapture tax rates. We will guide you on how to place your essay help, proofreading and editing your draft fixing the grammar, spelling, or formatting of your paper easily and cheaply. In most cases, youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. Rental property tax information doesn't have to be dull and boring. Step 1. SOLD MAY 6, 2022. End of example Figure out your overall gain on the sale of the property. 4 Beds. So, if you bought a property for $1 million and sold it for $1.5 million, your ROI would be: ($1.5 million $1 million) / $1 million = 0.5 or 50%. Capital Gains Tax Example. In order to qualify, the homeowner (s) must own and also use the home as a primary residence for at least 2 of the past 5 years. This can result in a small amount of tax basis in the property that you are trying to sell. The gain is the difference between the "adjusted basis" and the sale price. Suppose, for example, you want to buy a property for $250,000, but sell it for $350,000 after assuming it can be bought and held.An increase in capital of $350,000 x $250,000 would correspond to a $100,000 profit.The only half of a capital gain in Canada is that which is taxable, hence the $50,000 result Step 6: Subtract the cost of capital gain from the selling price of the property to know the net gain of the transaction. To give you a quick and dirty estimation of how much tax you would have to pay, you can simply use 50% as your tax rate. To avoid recognizing the gain on the sale of your first property, you can transfer your cost basis to the new property. There is a great tip about accounting for all It only refers to the time your property has an active tenant. Enter your Username and Password and click on Log In. To work out the gain, you simply deduct the "cost basis" of the house from the "net proceeds" you receive from the sale. List the dispositions of all your rental properties on Schedule 3, Capital Gains (or Losses).For more information on how to calculate your taxable capital gain, see Guide T4037, Capital Gains.. and up. If you sold the property for $600,000, your gain will be $163,000 ($600,000 amount realized minus $437,000 adjusted basis). First, determine your selling costs. How Are Capital Gains Calculated On Sale Of Rental Property? They incur costs of purchase, including stamp duty and legal fees of $30,000. 1. This means that half of the profit you earn from selling an asset is taxed, and the other half is yours to keep tax-free. Now, to calculate the rental propertys ROI, follow the previous cap rate formula and divide the annual return ($7,600) by the total investment you initially made ($110,000). and up. 9. You can determine your total gain by deducting the So the closing costs you paid to purchase the property and that you could not deduct previously are effectively deducted when you sell. It applies to the portion of the gain attributable to the depreciation deductions youve already taken. To conclude, a gain or loss on the sale of your rental property, you subtract your adjusted cost basis from the actual selling price of your rental property. Additionally, taxable gain on the sale may be subject to a 3.8% Net If this is a negative number, you've made a loss. To figure out the basis of property received as a gift, you must know three amounts: The donor's adjusted basis just before the donor made the gift. All the documents need to be submerged so they are completely saturated and can be broken down.